30-day money-back guarantee if you're not satisfied with the course content

The Investment Fundamentals for Ghanaians course is designed for individuals who want to build long-term wealth through strategic investing in Ghana's unique economic environment. This comprehensive program demystifies the investment landscape and provides practical strategies for both local and international investment opportunities.

Many Ghanaians are unsure how to grow their wealth beyond basic savings, especially in an environment of currency volatility and inflation. This course bridges that knowledge gap, providing clear guidance on how to make smart investment decisions that build lasting financial security and generational wealth.

This course is perfect for:

Graduates of our Investment Fundamentals course report:

Plus 5 more modules covering international investments, alternative assets, portfolio management, tax planning, and wealth preservation!

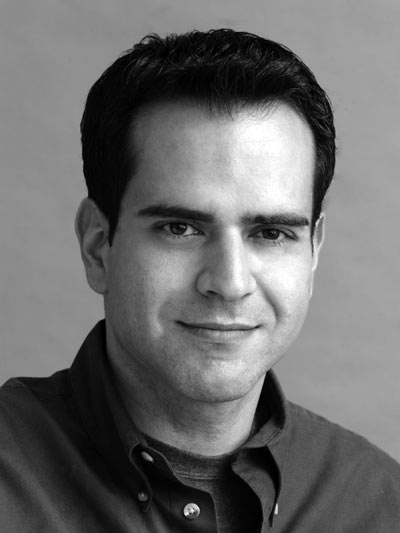

Digital Learning Manager & Investment Specialist at Aliocacita

Kofi Adu combines expertise in investment strategies with a passion for digital education. With a background in finance and technology, he specializes in making complex investment concepts accessible to everyday Ghanaians.

Before joining Aliocacita, Kofi worked as an investment analyst at Databank Group, one of Ghana's leading investment firms, where he gained firsthand experience in portfolio management, stock analysis, and client investment planning.

His teaching approach emphasizes practical, actionable investment strategies rather than theoretical concepts. Students particularly value his ability to explain complex financial markets in clear, relatable terms, and his focus on strategies that work within Ghana's unique economic environment.

I've been keeping money in fixed deposits for years, watching inflation eat away at my savings. This course opened my eyes to so many investment opportunities right here in Ghana that I never understood before. The section on analyzing GSE stocks was particularly valuable - I've now built a portfolio of 6 Ghanaian stocks and 2 fixed income instruments using the exact methods taught in the course. Already seeing better returns than my old approach, and I feel confident about my investment decisions for the first time.

The real estate investment module alone was worth the price of the course. I was about to purchase a property based on a friend's recommendation, but after going through the property valuation lessons, I realized it was significantly overpriced. The course gave me the tools to properly evaluate real estate investments, and I've since found a much better property with higher rental yield potential. I do wish there was more content on agriculture investments, which is why I'm giving 4 stars instead of 5.

Good introduction to investing in Ghana, but I found some of the content too basic for someone who already has some investment knowledge. The international investment module was excellent and provided strategies I hadn't considered before for diversifying outside Ghana. I appreciated the sections on taxation and the specific examples of how to execute different investment strategies. Would recommend for beginners, but intermediate investors might find parts of it too foundational.

This course provides strategies for investors at all levels, from those starting with as little as GHS 200 to those with significant capital. We cover investment options for various budget levels and explain how to build a portfolio incrementally over time. The principles apply regardless of your starting amount, and we provide specific guidance for beginners with limited funds.

No, this is a comprehensive investment course covering multiple asset classes. While we do cover the Ghana Stock Exchange in depth, we also provide extensive content on fixed income investments, real estate, international stocks, mutual funds, ETFs, alternative investments, and more. The goal is to help you build a diversified investment strategy across various asset classes.

This course focuses primarily on long-term wealth building through strategic investing rather than short-term trading or speculation. While we do discuss market timing and shorter-term opportunities, our core philosophy is centered on building sustainable wealth through fundamentally sound investments held for the medium to long term. If you're looking specifically for day trading techniques, this may not be the right course for you.

Rather than giving specific "buy this stock" recommendations that could quickly become outdated, we teach you the analytical frameworks and valuation methods to evaluate investments yourself. We do use real examples from the Ghanaian market to demonstrate these techniques, but the focus is on giving you the skills to make your own informed investment decisions based on your personal financial goals and risk tolerance.

Most free investment content online is either too general (not specific to Ghana's unique market conditions) or too promotional (pushing specific investment products). This course provides a structured, comprehensive education specifically tailored to Ghana's economic environment, regulatory framework, and available investment vehicles. We also provide proprietary analysis tools and templates you won't find elsewhere, plus the opportunity to ask questions during live coaching sessions.